Understanding the Role of Construction Accounting in Effective Financial Management

Wiki Article

Exploring the Relevance of Construction Bookkeeping in the Building Industry

The building industry runs under unique financial difficulties that necessitate a specific technique to bookkeeping. Construction accountancy not just makes certain the precision of economic coverage but additionally plays a critical duty in job administration by enabling effective task costing and source allowance. By recognizing its crucial principles and benefits, stakeholders can significantly affect job end results. Nonetheless, the complexities intrinsic in construction accounting raise questions concerning best techniques and the devices readily available to handle these intricacies successfully. What strategies can building and construction firms implement to optimize their economic procedures and drive success?One-of-a-kind Obstacles of Building Accounting

Often, building audit provides distinct obstacles that identify it from other fields. One key obstacle is the complicated nature of building and construction tasks, which often entail numerous stakeholders, varying timelines, and varying laws. These elements necessitate meticulous monitoring of prices connected with labor, materials, tools, and expenses to preserve job earnings.One more considerable obstacle is the need for precise task costing. Construction companies have to designate expenses to details projects properly, which can be challenging as a result of the long period of time of tasks and the potential for unpredicted expenditures. This requirement demands durable accountancy systems and techniques to make certain accurate and prompt monetary reporting.

Furthermore, the building market is prone to alter orders and agreement alterations, which can further complicate economic monitoring and projecting. Properly making up these adjustments is critical to avoid disagreements and ensure that projects remain within budget plan.

Key Principles of Construction Audit

What are the fundamental principles that lead building and construction accounting? At its core, building and construction bookkeeping revolves around precise monitoring of earnings and expenses linked with details projects.One more secret principle is the application of the percentage-of-completion approach. This technique acknowledges income and costs proportionate to the task's progression, providing an extra sensible view of financial performance gradually. Additionally, building accountancy emphasizes the relevance of compliance with accounting requirements and policies, such as GAAP, to make sure openness and dependability in economic coverage.

In addition, money circulation monitoring is vital, provided the usually intermittent nature of building and construction jobs. These concepts jointly develop a durable framework that supports the special monetary demands of the construction industry.

Advantages of Efficient Construction Accounting

Effective building accounting offers numerous benefits that significantly boost the overall management of tasks. Among the main benefits is boosted monetary presence, making it possible for job supervisors to track costs accurately and check cash flow in real-time. This transparency assists in notified decision-making, lessening the risk of spending plan overruns and guaranteeing that resources are alloted efficiently.Additionally, reliable construction bookkeeping boosts conformity with governing requirements and sector requirements. By preserving accurate economic documents, companies can quickly supply documents for audits and satisfy contractual obligations. This persistance not just promotes trust fund with clients and stakeholders yet additionally alleviates possible legal threats.

Additionally, efficient accountancy practices add to better project projecting. By evaluating past efficiency and monetary fads, building companies can make more exact predictions relating to future task expenses and timelines. construction accounting. This ability improves critical planning and enables business to respond proactively to market variations

Tools and Software Program for Building And Construction Bookkeeping

A variety of specialized tools and software program options are readily available for building accountancy, each designed to enhance economic management procedures within the market. These tools facilitate monitoring, reporting, and examining financial data details to building jobs, making sure precision and compliance with industry standards.Leading software options consist of incorporated construction monitoring systems that incorporate task administration, budgeting, and bookkeeping functionalities. Solutions such as Sage 300 Building and Genuine Estate, copyright for Service Providers, and Perspective View offer features tailored to deal with job setting you back, payroll, and invoicing, making it possible for building firms to maintain precise monetary oversight.

Cloud-based applications have actually acquired appeal because of their access and real-time cooperation capabilities. Tools like Procore and CoConstruct permit teams to accessibility monetary data from multiple locations, boosting communication and decision-making processes.

Additionally, building and construction audit software typically sustains compliance with regulative requirements, facilitating audit trails and tax coverage. The assimilation of mobile applications further enhances operational performance by permitting area personnel to input data directly, reducing errors and hold-ups.

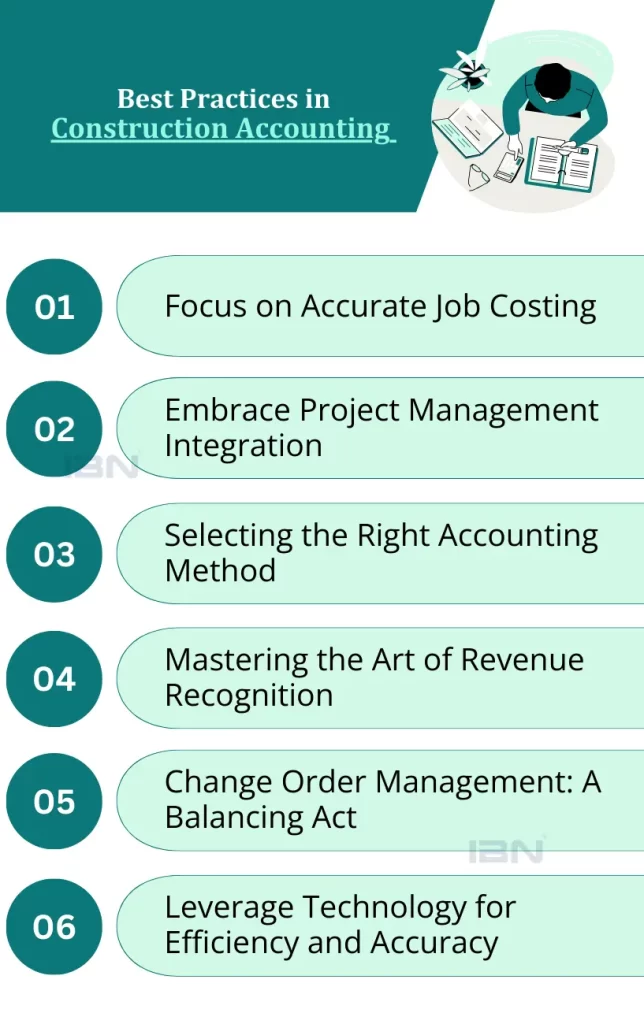

Ideal Practices for Building And Construction Financial Administration

Successful building and construction bookkeeping relies not just on the right devices and Web Site software program but likewise on the execution of finest methods for monetary administration. To accomplish efficient monetary oversight, construction companies must focus on routine and accurate project budgeting. This procedure involves damaging down project expenses right into comprehensive categories, which permits better tracking and projecting of expenditures.Another essential technique is preserving a durable system for invoicing and cash money flow monitoring. Prompt invoicing guarantees that payments are received without delay, while thorough capital tracking helps prevent liquidity problems. Additionally, building companies need to adopt a strenuous method to task setting you back, assessing the real prices against budgets to recognize variations and readjust strategies accordingly.

Moreover, fostering transparency with extensive economic coverage enhances stakeholder trust and aids in informed decision-making. Regular economic reviews and audits helpful site can additionally uncover potential ineffectiveness and areas for enhancement. Last but not least, constant training and growth of monetary management skills among personnel make sure that the group continues to be adept at navigating the intricacies of construction accountancy. By integrating these best techniques, construction companies can improve their monetary stability and drive job success.

Final Thought

In conclusion, construction accounting functions as a fundamental component of the construction sector, addressing special challenges and sticking to key concepts that enhance monetary precision. Effective audit methods produce substantial advantages, consisting of improved capital and compliance with regulative requirements. Using proper tools and software application better supports economic management efforts. By carrying out best practices, building and construction companies can cultivate stakeholder trust fund and make educated choices, ultimately adding to the overall success and sustainability of tasks within the market.Building accounting not just makes sure the precision of economic coverage but additionally plays a pivotal role in task administration by making it possible for efficient work costing and source appropriation. Furthermore, building accountancy emphasizes the relevance of compliance with audit standards and laws, such as GAAP, to make sure openness and dependability in financial reporting.

Effective construction bookkeeping relies next page not just on the right tools and software however likewise on the implementation of finest methods for monetary administration. Continual training and growth of economic administration abilities among personnel guarantee that the group remains proficient at navigating the complexities of construction accounting.In conclusion, building and construction accounting offers as a fundamental component of the building and construction industry, dealing with distinct challenges and sticking to vital concepts that enhance financial precision.

Report this wiki page